Although the importance of financial protection for future expenses is constantly being emphasized by banking authorities and advisors, it somehow still remains underrated. People tend to prioritize their present needs, and although there’s nothing wrong with that, it’s vital to ensure that you will have monetary resources when pressing situations to arise.

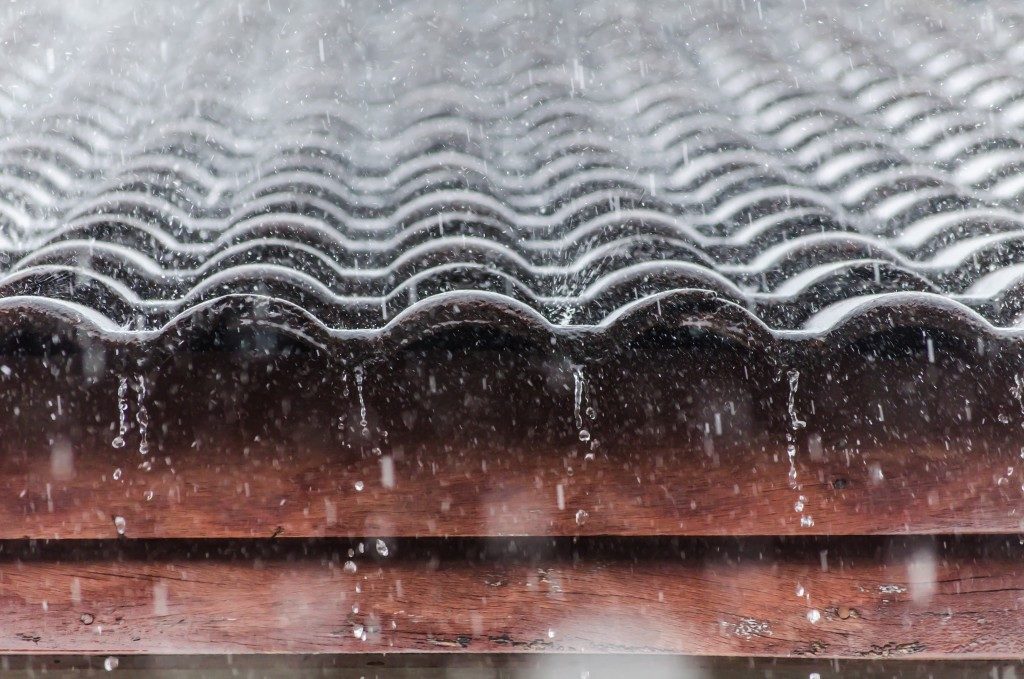

Being protected financially helps you make better choices instead of settling for whatever option is available. For instance, when you suddenly need to have certain areas of your home repaired or restored due to damages caused by disasters or accidents, you can choose high-quality services and not opt for short-term solutions because you can afford to.

In this article, we’ll discuss three security plans that are vital for every homeowner: home warranty, homeowners insurance, and emergency fund.

Home Warranty

According to American Home Shield, a home warranty is a 12-month service contract that can be used to finance repairs and replacements of major home system components and appliances in cases of failure and damages due to standard usage or natural wear and tear.

More specifically, a home warranty covers your HVAC system such as central heating ventilation, air conditioning, water heater, plumbing, and many more. In addition, depending on your specific plan, a home warranty can cover common appliances including washing machines, dryers, and kitchen appliances like stoves, refrigerators, and ovens. There are certain plans which even allow you to buy optional add-on coverage for other home system components.

Appliance repair for your Salt Lake City home is highly important because it prevents further damages. When necessary, it’s also good to opt for replacement, especially since you’ll want to make the most of your home warranty plan.

Homeowners Insurance

An article reviewed by Julia Kagan, a finance writer, and editor, homeowners insurance is typically property insurance covering damages and losses to a person’s house and home assets. Most homeowners insurance plans even provide liability coverage in cases of accidents that transpired within the home or property.

Granted, homes are expensive investments, especially in progressive cities with dense populations. In fact, statistics from BestPlaces.net show that in 2019, the median home cost in Provo, Utah amounts to $266,600 while in Salt Lake City, the figure goes up to $354,300. Accordingly, considering the value of your house, you will want to stay financially viable to afford its upkeep and repair. Thus, it’s advised that you purchase a homeowners insurance plan.

Emergency Fund

Having an emergency fund is important not just for the security of homeowners, but for every individual in general. This is not a long-term savings plan or a nest egg for major future expenses. It’s a fund that can only be tapped for financial crises and emergencies.

Regarding the amount, a basic rule of thumb is putting away around a value that’s worth three to six months’ of expenses. To generate this much money without compromising your regular spendings, it’s suggested that you put away a small every to a week or so until you reach your goal.

Emergency situations occur by nature, and because they are unpredictable, it’s best to be prepared financially. This allows you to prevent straining your day-to-day expenses in moments of crisis. Consult a financial expert and talk about suitable plan options for your specific lifestyle needs.